Active Portfolio

Des Plaines Condo Deconversion

Date Purchased: December 2021

Building Mix: 30 2-beds and 5 1-beds

Purchase Price: $2,575,000 + $4,250,000 rehab budget

Return: projected 6.7% CAP Rate and 13.7% cash-on-cash

WORKFORCE HOUSING IN MI

Date Purchased: November 2021

Building Mix: 108 Units Consisting of 25 3-beds / 83 1-beds

Purchase Price: $10,000,000

Return: Projected 7.5% CAP Rate at stabilization with projected 13.5% cash-on-cash

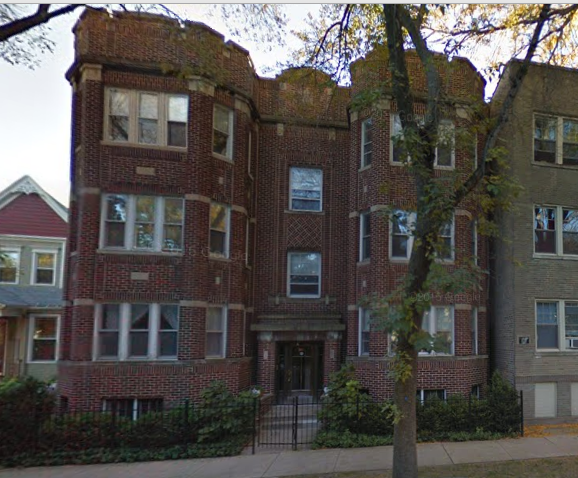

DES PLAINES, IL PORTFOLIO

Date Purchased: 2018-2019

Building Mix: 3 buildings total consisting of 1 3-bed, 18 2-beds and 21 1-beds

Purchase Price: $4,300,000 + $2,400,000 rehab budget

Return: 8.1% CAP Rate and 16% cash-on-cash

B-CLASS APT CONVERSION IN ARL HTS, IL

Date Purchased: October 2018

Building Mix: 78 Units Consisting of 4 3-beds, 26 2-beds and 48 1-beds

Purchase Price: $8,800,000 + $5,500,000 rehab budget

Return: 6.25% CAP Rate with 8.5% cash-on-cash (based on low leverage refinance)

ELKHART, IN REDEVELOPMENT

Date Purchased: September 2018

Building Mix: 84 Units Consisting of 12 3-beds, 57 2-beds and 15 1-beds

Purchase Price: $1,800,000 + $3,400,000 rehab budget

Return: 7.9% CAP Rate and 17.5% cash-on-cash return on originally invested equity

Notes: 100% of investor capital returned within 22 months of initial acquisition

WOMEN & CHILDREN SHELTER IN CHICAGO

Date Purchased: July 2018

Building Mix: 22 Units to house ~100 women/children in need of safe housing

Purchase Price: $250,000 + $1,800,000 rehab budget

Return: 12.3% CAP Rate and 25% Cash on Cash

Notes: As part of a "passion project" this development yielded significant returns and was ultimately sold in December of 2021

LINCOLN SQUARE CONDO CONVERSION

Date Purchased: June 2016

Building Mix: 6 Residential Units

Purchase Price: $918,000

Return: Projected annual return on investment of 70% in 18 months

Notes: Condo conversion of center-entrance 6-flat into luxury condominiums

ADAPTIVE REUSE IN CHICAGO

Date Purchased: October 2015

Building Mix: 15,000 sf mixed use building (office, retail, apartments)

Purchase Price: $2,500,000

Return: Projected annual cash-on-cash return of 12%

Notes: Gut renovation of 4 apartments and three floors of office/retail space

EDGEWATER 6-FLAT

Date Purchased: October 2015

Building Mix: 6 Residential Units

Purchase Price: $656,000

Return: Projected cash-on-cash return of 10% for 3 year hold

EAST VILLAGE WALK-UP

Date Purchased: February 2012

Building Mix: 8 Residential Units

Purchase Price: $825,000

Return: Projected return on investment of 14% for 5-7 year hold

Notes: 100% of investor capital has Benn returned to date, in just under a 3 year hold period